Finance Coach Certification

Your Guide to Finance Coach Certification: Top Programs Explained

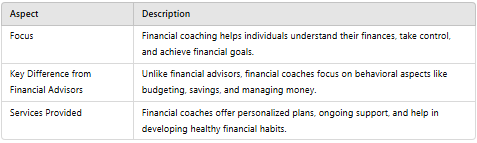

What is Financial Coaching?

Financial coaching is a service that helps individuals understand finances, take control of money, and achieve financial goals.

Financial coaches provide personalized financial plans, ongoing support, and help clients develop healthy financial habits.

Financial coaching is distinct from traditional financial advising or planning, focusing on behavioral and psychological aspects of money management. A financial advisor typically provides investment management and comprehensive financial planning.

Financial advisors handle investment management and offer a broader range of financial planning services, whereas financial coaches focus on budgeting and behavioral aspects of money management.

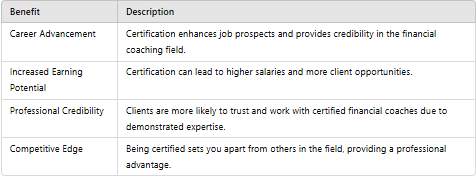

Benefits of Becoming a Certified Financial Coach

Obtaining certification as a financial coach can significantly enhance your career prospects and credibility in the field.

Certification can provide a competitive edge in the job market and demonstrate your expertise and commitment to the profession.

Certified financial coaches can increase their earning potential and attract more clients.

Top Financial Coach Certification Programs

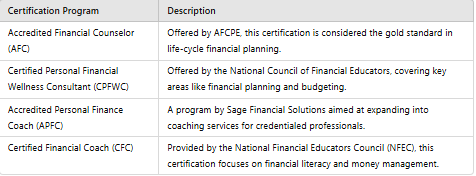

Accredited Financial Counselor (AFC) Certification

The Accredited Financial Counselor Certification is offered through the Association for Financial Counseling and Planning Education (AFCPE).

To get certified, you must complete four steps: education, examination, experience, and ethics.

The AFC certification is considered the gold standard for financial professionals who are interested in life-cycle planning.

Certified Personal Financial Wellness Consultant (CPFWC)

The National Council of Financial Educators offers a certification program designed for people who are interested in building a coaching practice.

The program covers several core areas, including financial planning, budgeting, and investment planning.

You’ll have access to prerecorded training videos, live weekly webinars, and course manuals.

Accredited Personal Finance Coach (APFC)

The Accredited Personal Finance Coach certification from Sage Financial Solutions is designed for credentialed professionals who want to expand into coaching services.

To complete the program, you must have at least one approved co-requisite from a list of approved credentials.

You may complete your co-requisite credential alongside your APFC certification.

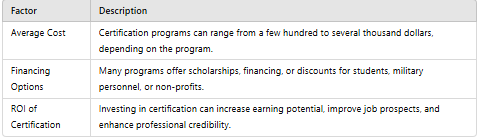

Cost and Investment of Certification Programs

The cost of certification programs for financial coaches can vary widely depending on the program, its duration, and the level of expertise it offers. On average, certification programs can range from a few hundred dollars to several thousand dollars. For example, the National Financial Educators Council (NFEC) offers a Certified Personal Financial Wellness Consultant certification program that costs around $1,495. The Association for Financial Counseling and Planning Education (AFCPE) offers an Accredited Financial Counselor certification program that costs around $1,295.

It’s essential to consider the cost of certification programs as an investment in your career as a financial coach. While the initial cost may seem high, it can lead to increased earning potential, improved job prospects, and a higher level of credibility in the industry. Additionally, many certification programs offer financing options, scholarships, or discounts for students, military personnel, or non-profit organizations.

When evaluating the cost of a certification program, consider the following factors:

The program’s reputation and accreditation

The level of expertise and knowledge it offers

The duration of the program and the time commitment required

The cost of materials, such as textbooks or online resources

The potential return on investment, including increased earning potential and improved job prospects

Online vs. In-Person Certification Programs

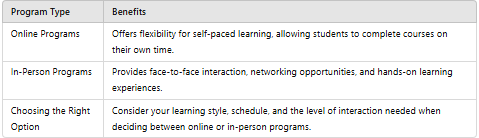

Certification programs for financial coaches can be offered online or in-person, depending on the provider and the program. Online certification programs offer flexibility and convenience, allowing students to complete coursework at their own pace and on their own schedule. In-person certification programs, on the other hand, offer face-to-face interaction with instructors and peers, which can be beneficial for networking and building relationships.

When choosing between an online and in-person certification program, consider the following factors:

Your learning style and preferences

Your schedule and availability

The level of interaction and support you need from instructors and peers

The program’s reputation and accreditation

The cost and investment required

Online certification programs can be a good option for those who:

Have busy schedules or limited time to attend in-person classes

Prefer self-paced learning and flexibility

Need to balance work and family responsibilities with education

In-person certification programs can be a good option for those who:

Prefer face-to-face interaction and networking opportunities

Need hands-on training and practice

Value the support and guidance of instructors and peers

Continuing Education and Recertification

Continuing education and recertification are essential for financial coaches to stay up-to-date with industry developments, best practices, and regulatory changes. Many certification programs require continuing education credits to maintain certification, and some may require recertification after a certain period.

The National Financial Educators Council (NFEC) requires certified financial coaches to complete 30 hours of continuing education every two years to maintain certification. The Association for Financial Counseling and Planning Education (AFCPE) requires certified financial counselors to complete 60 hours of continuing education every five years to maintain certification.

When choosing a certification program, consider the following factors:

The program’s continuing education requirements

The cost and investment required for continuing education

The program’s recertification requirements and process

The program’s support and resources for continuing education and recertification

Continuing education and recertification can help financial coaches:

Stay current with industry developments and best practices

Maintain credibility and expertise in the industry

Enhance their skills and knowledge

Increase their earning potential and job prospects

Other Notable Certifications for Financial Coaches

The Financial Coach Academy provides tools and knowledge to build a successful financial coaching business.

The National Financial Educators Council (NFEC) offers financial coach certification programs for individuals who want to improve their capabilities to teach financial literacy and money management.

The Certified Financial and Career Coach certification from the National Association of Certified Credit Counselors is designed to enable coaches to assist clients with managing their financial and professional lives.

Building a Successful Financial Coaching Business

To build a successful financial coaching business, you need to develop a strong understanding of personal finance and coaching techniques.

You should also have a solid business plan, including marketing strategies and a pricing structure.

Building a strong network of contacts and partners can also help you grow your business.

What to Expect from a Career as a Financial Coach

As a financial coach, you can expect to work with clients to help them achieve their financial goals.

You may work with individuals, couples, or small businesses, and provide guidance on budgeting, saving, and investing.

You may also work with clients to help them develop healthy financial habits and overcome financial challenges.

The Future of the Financial Coaching Industry

The demand for financial coaching services is expected to grow in the coming years, driven by an increasing need for personalized financial guidance.

Technology is also expected to play a larger role in the industry, with online coaching platforms and digital tools becoming more prevalent.

The industry is also expected to become more regulated, with a greater emphasis on certification and professional standards.

Expanding Access to Financial Coaching Services

Expanding access to financial coaching services is critical to helping more people achieve financial stability and security.

This can be achieved through online coaching platforms, community-based programs, and partnerships with financial institutions.

Financial coaches can also work with underserved populations, such as low-income individuals and families, to provide them with access to financial education and coaching.

Conclusion

Becoming a certified financial coach can be a rewarding and lucrative career path.

With the right training and certification, you can help individuals and families achieve their financial goals and build a successful financial coaching business.

FAQs

Q1: What is the average salary for a financial coach?

The average salary for a financial coach can vary depending on experience, location, and clientele. On average, financial coaches earn between $45,000 and $80,000 per year. However, experienced coaches with established client bases or those offering specialized services can earn significantly more, sometimes exceeding $100,000 annually. Additionally, financial coaches who operate their own businesses may earn higher incomes based on the number of clients they serve and their pricing structure.

Q2: Do I need to be certified to become a financial coach?

No, certification is not required to become a financial coach, but it is highly recommended. Certification can enhance your credibility, increase client trust, and provide you with the skills needed to effectively help clients manage their finances. Several respected certification programs, such as the Accredited Financial Counselor (AFC) or Certified Personal Financial Wellness Consultant (CPFWC), are available to ensure that coaches meet industry standards and demonstrate a commitment to professional development.

Q3: What are the benefits of becoming a certified financial coach?

Becoming a certified financial coach provides several benefits, including:

Enhanced Credibility: Certification demonstrates your expertise and commitment to ethical practices in the financial coaching industry.

Increased Earning Potential: Certified coaches can charge higher fees and attract more clients due to their recognized qualifications.

Competitive Edge: Certification sets you apart from non-certified competitors in the job market, giving you a distinct advantage when seeking clients or employment.

Career Advancement: Certification can open up more career opportunities and allow you to specialize in areas such as personal finance, business finance, or wellness coaching.

Q4: How do I find a financial coach certification program?

To find a financial coach certification program, start by researching reputable organizations that offer training and certification. Some well-known programs include:

Accredited Financial Counselor (AFC) certification offered by the AFCPE.

Certified Personal Financial Wellness Consultant (CPFWC) from the National Council of Financial Educators.

Accredited Personal Finance Coach (APFC) from Sage Financial Solutions. These programs are available online or in-person and offer different levels of commitment, cost, and specialization. You can find these programs by visiting their respective websites, reading reviews, and comparing course offerings. Consider factors such as reputation, curriculum, and support when choosing the best certification program for your goals.