Financial Management Hacks Every Coaching Business Must Know

Most coaches master the art of transformation for their clients—but struggle when it comes to managing money in their own businesses. Without clear financial systems, even a profitable coaching practice can feel unstable. Many coaches earn well but end up stressed, unsure of where the money goes, or unprepared for taxes and unexpected expenses.

Financial management is the backbone of sustainability. It allows coaches to make confident decisions, reinvest strategically, and scale without fear of collapse. By applying the right financial hacks—covering budgeting, cash flow, taxes, investments, and tracking tools—coaches can protect profits and unlock consistent growth. This guide reveals the essential financial management hacks every coaching business should implement. From budgeting methods and tax strategies to investment planning and digital tools, you’ll learn how to turn income into long-term stability.

Why Financial Management Matters for Coaches

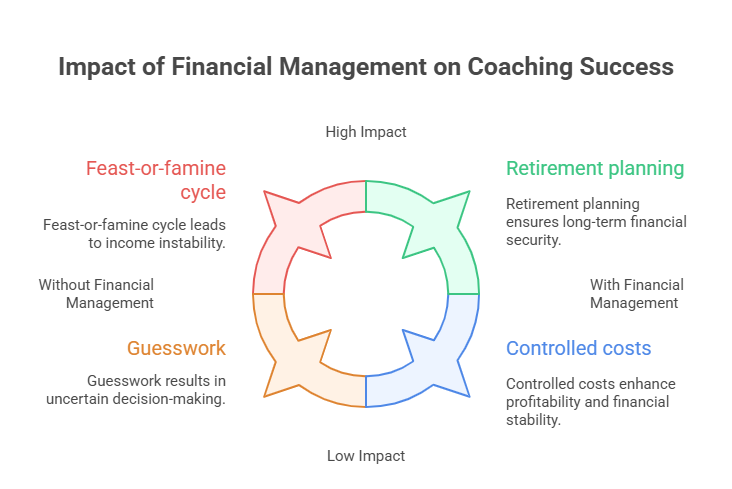

Preventing the Feast-or-Famine Cycle

Many coaches operate without structured financial systems, leading to inconsistent income patterns. One month feels abundant, while the next brings stress. Financial management creates stability by forecasting expenses, preparing for slow seasons, and ensuring that cash reserves are available. This eliminates constant anxiety and helps coaches focus on serving clients instead of worrying about money.

Enabling Confident Business Decisions

Without accurate financial tracking, decisions around hiring, marketing spend, or program launches are risky guesses. Strong financial management equips coaches with real data on revenue, expenses, and profitability, enabling smarter choices. Whether expanding into group programs or investing in software, financial clarity ensures every move is strategic, not impulsive.

Protecting Profitability

A coaching business can generate impressive top-line revenue but still operate at razor-thin margins if expenses aren’t managed. Monitoring profit margins, recurring costs, and unnecessary overhead safeguards profitability. Coaches who track financial health consistently have the resources to reinvest in growth and weather downturns.

Building Long-Term Security

Financial management isn’t just about today—it’s about building resilience for the future. Setting aside funds for taxes, retirement, and emergency reserves ensures the business can withstand unexpected challenges. By thinking beyond short-term revenue and planning for sustainability, coaches position themselves for long-term stability and wealth creation.

Budgeting & Cash Flow Management

Why Budgeting is Critical for Coaches

A budget is not about restricting growth—it’s about directing it. For many coaches, money flows in without a clear plan, leaving expenses unchecked. A budget provides visibility and intentionality, ensuring that income is allocated toward essentials like taxes, savings, marketing, and growth initiatives. With a budget, coaches can confidently reinvest profits rather than react to unexpected shortfalls.

Building a Coaching Business Budget

An effective coaching budget should include:

Fixed Costs: Tools, subscriptions, office space, or staff salaries.

Variable Costs: Marketing campaigns, event hosting, or outsourced projects.

Growth Allocation: Investments in certification, training, or technology upgrades.

Owner’s Pay & Taxes: Non-negotiable categories to avoid financial stress.

By setting percentages for each category, coaches create predictable systems. For example, assigning 30% to taxes, 20% to marketing, 10% to tools, and 40% to pay ensures every dollar has a purpose.

Managing Cash Flow Cycles

Unlike traditional jobs, coaching revenue can be irregular. Clients may pay in full, on installments, or seasonally. This unpredictability makes cash flow management essential. The key is smoothing inflows and outflows. Tactics include:

Encouraging clients to adopt recurring payment plans.

Creating subscription-style offers for steady income.

Tracking receivables closely to prevent late payments.

Keeping at least 2–3 months of operating expenses in reserves.

These strategies transform inconsistent cash flow into reliable stability.

Tools and Systems for Tracking

Spreadsheets can work in the early stages, but as revenue grows, specialized tools are vital. Platforms like QuickBooks, FreshBooks, or Wave provide automated insights into income and expenses. Pairing these with a CRM ensures client billing is accurate and timely. By reviewing cash flow monthly, coaches spot trends, identify overspending, and make adjustments before problems escalate.

Linking Budgeting to Growth

Smart budgeting and cash flow management give coaches leverage. When income is stable, opportunities like launching new programs, hiring assistants, or scaling marketing campaigns become less risky. In essence, financial structure becomes a growth engine, ensuring every dollar contributes to scaling rather than slipping through unnoticed.

Smart Tax Strategies for Coaches

Understanding Tax Obligations

Coaching businesses, especially for solopreneurs, often face confusion around tax responsibilities. Unlike salaried employees, coaches must manage self-employment taxes, estimated quarterly payments, and deductions. Missing these obligations can lead to penalties and cash flow crunches. A proactive tax strategy ensures compliance while maximizing savings.

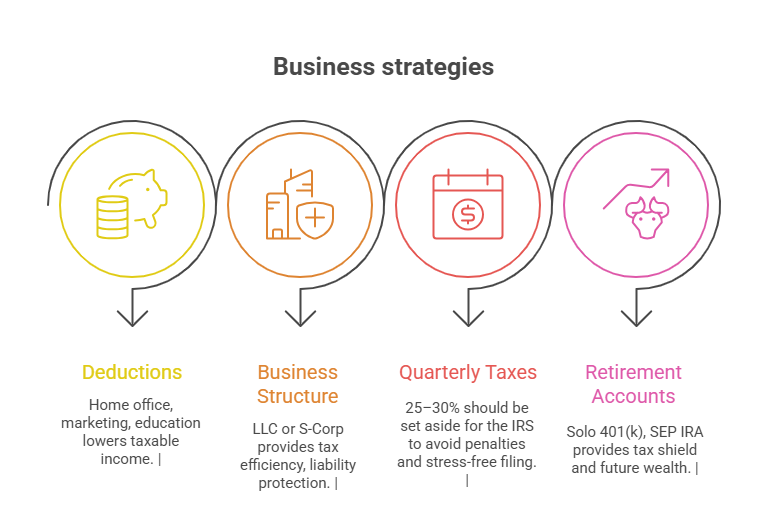

Leveraging Business Deductions

One of the simplest ways to reduce tax liability is through deductions. Common deductions for coaches include:

Home office expenses (internet, utilities, office equipment).

Professional development (courses, certifications, coaching programs).

Marketing costs (ads, website hosting, email platforms).

Travel and client meetings (when business-related).

By carefully tracking expenses, coaches can legally reduce taxable income, increasing net profits without extra revenue.

Structuring the Business for Tax Efficiency

The way a coaching business is structured significantly impacts taxes. Operating as a sole proprietor may be simple, but forming an LLC or S-Corp often brings tax advantages. For instance, S-Corp status can reduce self-employment taxes by allowing part of income to be classified as salary and the rest as distributions. Consulting with a tax advisor ensures the structure aligns with both income level and long-term goals.

Planning with Quarterly Taxes

Unlike employees, coaches must prepay taxes quarterly. Failing to do so results in interest and penalties. Setting aside 25–30% of revenue in a dedicated tax account ensures funds are always available. Many coaches automate this process, moving a percentage of every payment into the account, making quarterly tax deadlines stress-free.

Using Retirement Contributions as a Tax Shield

Retirement contributions not only secure the future but also reduce taxable income. Options like a SEP IRA, Solo 401(k), or SIMPLE IRA allow coaches to shelter thousands annually from taxes while building long-term wealth. For high-earning coaches, these accounts can significantly reduce current liability while compounding growth for retirement.

Why Professional Guidance Matters

Taxes are nuanced, and every coach’s situation is unique. Working with a CPA or tax strategist ensures maximum deductions, optimized business structure, and compliance. The cost of expert advice is often dwarfed by the tax savings it generates. Smart tax strategies don’t just minimize what you owe—they provide confidence and clarity, allowing coaches to focus on growth.

Investment Approaches for Long-Term Growth

Why Coaches Must Think Beyond Revenue

Earning income from coaching is important, but wealth comes from how that income is managed and invested. Without a growth plan, even high-earning coaches risk plateauing. Investments allow your money to compound, creating long-term security and freedom that coaching income alone cannot provide.

Reinvesting in the Business

The first and often best investment is reinvesting profits into your coaching business. This includes upgrading technology, pursuing certifications, or hiring staff to scale delivery. Every dollar allocated to growth activities can multiply future revenue, making business reinvestment one of the highest ROI investments.

Building Retirement Wealth

Beyond the business, coaches should secure their future through retirement accounts. Options like a Solo 401(k), SEP IRA, or Roth IRA allow tax-advantaged contributions while building long-term wealth. Contributing consistently—even in small amounts—creates compounding growth. This ensures that financial freedom doesn’t rely solely on continuous client acquisition in later years.

Diversifying Through Traditional Investments

To balance stability and growth, coaches can also diversify into traditional assets. Index funds, ETFs, and real estate are popular for building passive income streams and protecting against market volatility. These investments spread risk across multiple sectors, ensuring that wealth continues to grow even if the coaching industry shifts.

Creating a Balanced Investment Strategy

Long-term financial success comes from balance. Coaches should allocate funds across business reinvestment, retirement planning, and diversified assets. The key is not chasing quick wins but building predictable, compounding wealth over time. With consistent investment habits, coaching income transforms into lasting financial security.

| Investment Area | Examples | Key Benefit |

|---|---|---|

| Business Reinvestment | Certifications, hiring, software | Highest ROI, fuels scalability |

| Retirement Planning | Solo 401(k), SEP IRA, Roth IRA | Tax-advantaged long-term wealth |

| Traditional Investments | Index funds, ETFs, real estate | Diversification + passive income |

| Balanced Strategy | Mix of reinvestment + retirement + assets | Stability + compounding growth |

Tools & Software for Financial Tracking

Why Digital Tools Matter

Manual spreadsheets can work early on, but as revenue grows, financial complexity increases. Coaches managing multiple income streams, expenses, and tax obligations need dedicated financial tracking tools. These platforms automate reporting, reduce human error, and provide real-time insights, making decision-making faster and more accurate.

Accounting & Bookkeeping Software

Platforms like QuickBooks, FreshBooks, and Wave are the gold standard for small business financial management. They track income, categorize expenses, and generate profit-and-loss statements instantly. Many also integrate with bank accounts and payment processors, ensuring every transaction is logged automatically. For coaches, this eliminates guesswork around monthly financial health.

Cash Flow & Budgeting Tools

To manage irregular income cycles, budgeting tools such as YNAB (You Need a Budget) or Float help forecast cash flow and allocate funds effectively. They allow coaches to assign every dollar to categories like taxes, marketing, or savings. These tools provide clarity on spending while ensuring cash reserves are maintained for stability.

All-in-One Coaching Business Platforms

Some CRMs and coaching-specific platforms, like HoneyBook or Dubsado, combine client management with invoicing and payment tracking. This integration reduces admin work and centralizes financial data, ensuring that client payments flow seamlessly into your financial system.

Choosing the Right Fit

The best tool depends on your business stage. Start lean with free or low-cost apps, then graduate to advanced systems as revenue expands. What matters most is consistency—using financial tools daily ensures data accuracy and empowers coaches to make proactive financial decisions instead of reactive ones.

| Category | Examples | Primary Use |

|---|---|---|

| Accounting & Bookkeeping | QuickBooks, FreshBooks, Wave | Income & expense tracking |

| Cash Flow & Budgeting | YNAB, Float | Forecasting & allocations |

| All-in-One Platforms | HoneyBook, Dubsado | Client billing + contracts + payments |

| Spreadsheets (Starter) | Google Sheets, Excel | Early-stage simple tracking |

How the Health and Life Coaching Certification by ANHCO Supports Smarter Financial Management

Building Professional Authority

Financial growth depends on more than just smart budgeting—it relies on credibility. The Health and Life Coaching Certification by ANHCO provides coaches with professional recognition that makes it easier to justify premium pricing, secure long-term contracts, and expand into new markets. Stronger authority translates into higher and more predictable revenue, which simplifies financial planning.

Enabling Consistent Delivery

When revenue streams expand into group programs, corporate packages, or online courses, consistency becomes critical. ANHCO’s certification equips coaches with standardized, evidence-based frameworks that can be replicated across offers. This ensures clients receive consistent results, reducing churn and stabilizing income—two vital pillars of financial security.

Supporting Team Training & Delegation

As coaching practices grow, outsourcing and team support become necessary. Certification provides ready-made frameworks and methodologies that team members can easily adopt, ensuring uniform service delivery. This scalability not only protects quality but also creates financial predictability as the business transitions from solopreneurship to team-based operations.

Unlocking Growth Opportunities

Finally, ANHCO certification opens doors to corporate partnerships, collaborations, and advanced programs that require recognized credentials. These opportunities often come with larger, more stable contracts, strengthening both revenue diversification and financial sustainability. By anchoring credibility in certification, coaches move from reactive financial management to proactive long-term growth strategies.

Frequently Asked Questions

-

Financial management is the backbone of a sustainable coaching practice. Without it, even profitable coaches can face instability, stress, and burnout. By tracking income, managing expenses, and forecasting cash flow, coaches gain clarity and control over their money. This allows for strategic decisions—such as when to invest in marketing, hire support staff, or expand into new programs—without risking financial collapse. Strong financial systems also protect against the feast-or-famine cycle, ensuring consistent income. Ultimately, financial management isn’t just about bookkeeping; it’s about creating a business that grows with confidence and long-term security.

-

An effective budget should give every dollar a purpose. Start by listing fixed costs (subscriptions, tools, office space), variable costs (marketing, events, freelancers), and growth investments (certifications, technology, team hiring). Allocate percentages of monthly revenue to each category, ensuring that taxes and owner’s pay are treated as non-negotiable. For example, setting aside 30% for taxes, 20% for marketing, 10% for systems, and 40% for pay creates structure. Reviewing the budget monthly ensures adjustments can be made based on real performance. A budget isn’t restrictive—it’s a roadmap for stability and growth.

-

Cash flow management ensures you never run out of money between client payments. Coaches can stabilize cash flow by offering recurring payment plans for clients, creating subscription-style services, and tracking receivables closely. Keeping at least 2–3 months of operating expenses in reserves acts as a safety net. Tools like YNAB, Float, or accounting software can forecast inflows and outflows, giving visibility into potential shortfalls. Consistency is key—reviewing cash flow weekly or monthly allows for proactive decisions rather than reactive scrambling, making the business financially resilient.

-

Coaches can significantly reduce tax liabilities by leveraging deductions, business structure, and retirement contributions. Common deductions include home office expenses, marketing costs, professional development, and travel. Structuring the business as an LLC or S-Corp can provide additional tax advantages, depending on income levels. Setting aside 25–30% of income in a dedicated tax account ensures quarterly payments are made on time, avoiding penalties. Retirement plans such as a SEP IRA or Solo 401(k) not only build wealth but also reduce taxable income. Working with a CPA ensures maximum savings while staying compliant.

-

The smartest approach combines business reinvestment, retirement planning, and diversified assets. Business reinvestment—such as upgrading systems, certifications, or team hiring—yields some of the highest ROI by fueling growth. Retirement accounts like Roth IRAs or Solo 401(k)s create long-term compounding wealth. Beyond the business, coaches should diversify through index funds, ETFs, or real estate for additional stability and passive income. The key is balance: avoid chasing risky opportunities and instead commit to consistent, compounding investments. Over time, this approach transforms coaching revenue into sustainable financial security.

-

At minimum, coaches need accounting software like QuickBooks, FreshBooks, or Wave to track income and expenses. For irregular income cycles, budgeting tools like YNAB or Float help allocate funds effectively and maintain reserves. For client management, platforms like HoneyBook or Dubsado combine invoicing, contracts, and payment tracking in one place. These tools save time, reduce errors, and provide real-time insights into profitability. The choice depends on business stage, but consistency matters most—using tools daily ensures accurate data and empowers better decision-making.

Summing Up: Smarter Finances

Strong financial management is what separates coaching practices that survive from those that truly scale. By mastering budgeting, cash flow, taxes, investments, and financial tools, coaches move from reactive money handling to proactive wealth building. The result is stability, clarity, and the freedom to focus on client transformation without financial stress.

The truth is, revenue alone doesn’t guarantee success—structure does. Coaches who implement financial systems gain the confidence to reinvest in growth, hire strategically, and diversify revenue streams without fear of collapse. With stability in place, expansion becomes sustainable and predictable.

Smarter financial practices don’t just protect profits—they build resilience, unlock new opportunities, and ensure long-term freedom. For coaches ready to scale, mastering money isn’t optional—it’s the ultimate hack for sustainable success.